Well You Have To, Don’t You?

When I worked at Futures Truth, we tested everything with our Excalibur software. This software used individual contract data and loaded the entire history (well, the part we maintained) of each contract into memory and executed rollovers at a certain time of the month. Excalibur had its limitations as certain futures contracts had very short histories and rollover dates had to be predetermined – in other words, they were undynamic. Over the years, we fixed the short history problem by creating a dynamic continuous contract going back in time for the number of days required for a calculation. We also fixed the database with more appropriate rollover frequency and dates. So in the end, the software simulated what I had expected from trading real futures contracts. This software was originally written in Fortran and for the Macintosh. It also had limitations on portfolio analysis as it worked its way across the portfolio, one complete market at a time. Even with all these limitations, I truly thought that the returns more closely mirrored what a trader might see in real time. Today, there aren’t many, if any, simulation platforms that test on individual contracts. The main reasons for this are the complexity of the software, and the database management. However, if you are willing to do the work, you can get close to testing on individual contract data with EasyLanguage.

Step 1 – Get the rollover dates

This is critical as the dates will be used to roll out of one contract and into another. In this post, I will test a simple strategy on the crude futures. I picked crude because it rolls every month. Some data vendors use a specific date to roll contracts, such as Pinnacle data. In real time trading, I did this as well. We had a calendar for each month, and we would mark the rollover dates for all markets traded at the beginning of each month. Crude was rolled on the 11th or 12th of the prior month to expiration. So, if we were trading the September 2022 contract, we would roll on August 11th. A single order (rollover spread) was placed to sell (if long) the September contract and buy the October contract at the market simultaneously. Sometimes we would leg into the rollover by executing two separate orders – in hopes of getting better execution. I have never been able to find a historic database of when TradeStation performs its rollovers. When you use the default @CL symbol, you allow TradeStation to use a formula to determine the best time to perform a rollover. This was probably based on volume and open interest. TradeStation does allow you to pick several different rollover triggers when using their continuous data.

I am getting ahead of myself, because we can simply use the default @CL data to derive the rollover dates (almost.) Crude oil is one of those weird markets where LTD (last trade days) occurs before FND (first notice day.) Most markets will give you a notice before they back up a huge truck and dump a 1000 barrels of oil at your front door. With crude you have to be Johnny on the spot! Rollover is just a headache when trading futures, but it can be very expensive headache if you don’t get out in time. Some markets are cash settled so rollover isn’t that important, but others result in delivery of the commodity. Most clearing firms will help you unwind an expired contract for a small fee (well relatively small.) In the good old days your full service broker would give you heads up. They would call you and say, “George you have to get out of that Sept. crude pronto!” Some firms would automatically liquidate the offending contract on your behalf – which sounds nice but it could cost you. Over my 30 year history of trading futures I was caught a few times in the delivery process. You can determine these FND and LTD from the CME website. Here is the expiration description for crude futures.

Trading terminates 3 business day before the 25th calendar day of the month prior to the contract month. If the 25th calendar day is not a business day, trading terminates 4 business days before the 25th calendar day of the month prior to the contract month.

You can look this up on your favorite broker’s website or the handy calendars they send out at Christmas. Based on this description, the Sept. 2022 Crude contract would expire on August 20th and here’s why

- August 25 is Tuesday

- August 24 is Monday- DAY1

- August 21 is Friday – DAY2

- August 20 is Thursday – DAY3

This is the beauty of a well oiled machine or exchange. The FND will occur exactly as described. All you need to do is get all the calendars for the past ten years and find the 25th of the month and count back three business days. Or if the 25 falls on a weekend count back four business days. Boy that would be chore, would it not? Luckily, we can have the data and an EasyLanguage script do this for us. Take a look at this code and see if it makes any sense to you.

I have created a tool to print out the FND or LTD of any commodity futures by examining the date. In this example, I am using a Switch-Case to determine what logic is applied to the chart symbol. If the chart symbol is @CL, I look to see if the 25th of the month exists and if it does, I print the date 3 days prior out. If today’s day of month is greater than 25 and the prior day’s day of month is less than 25, I know the 25th occurred on a weekend and I must print out the date four bars prior. These dates are FN dates and cannot be used as is to simulate a rollover. You had best be out before the FND to prevent the delivery process. Pinnacle Date rolls the crude on the 11th day of the prior month for its crude continuous contracts. I aimed for this day of the month with my logic. If the FND normally fell on the 22nd of the month, then I should back up either 9 or 10 business days to get near the 11th of the month. Also I wanted to use the output directly in an EasyLanguage strategy so I modified my output to be exact EasyLanguage.

Now. that I had the theoretical rollover dates for my analysis I had to make sure the data that I was going to use matched up exactly. As you saw before, you can pick the rollover date for your chart data. And you can also determine the discount to add or subtract to all prior data points based on the difference between the closing prices at the rollover point. I played around with the number of days prior to FND and selected non adjusted for the smoothing of prior data.

How did I determine 8 days Prior to First Notice Date? I plotted different data using a different number of days prior and determined 8 provided a sweet spot between the old and new contract data’s open interest. Can you see the rollover points in the following chart? Ignore the trades – these were a beta test.

The dates where the open interest creates a valley aligned very closely with the dates I printed out using my FND date finder function. To be safe, I compared the dates and fixed my array data to match the chart exactly. Here are two rollover trades – now these are correct.

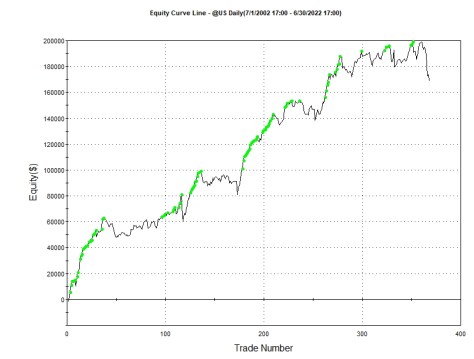

This post turned out to be a little longer than I thought, so I will post the results of using an adjusted continuous contract with no rollovers, and the results using non-adjusted concatenated contracts with rollovers. The strategy will be a simple 40/20 bar Donchian entry/exit. You maybe surprised by the results – stay tuned.